Strategic move or desperate response to the softening market?

Tesla, the world’s leading electric vehicle (EV) maker led by CEO Elon Musk, is facing a period of turbulence. The company is grappling with declining sales, a slumping stock price, and intensifying competition.

This has forced it to implement substantial price reductions across its vehicle lineup in response to a series of challenges in both the Chinese and US markets in an effort to bolster sales amidst declining demand, intensified competition, and operational setbacks.

Tesla’s woes began with a significant drop in sales. In China, a key market, sales dipped 3.6% in the first quarter of 2024 compared to the previous quarter. Globally, deliveries fell by a steeper 31% in Q1, leading to an immediate 5% plunge in the company’s stock price.

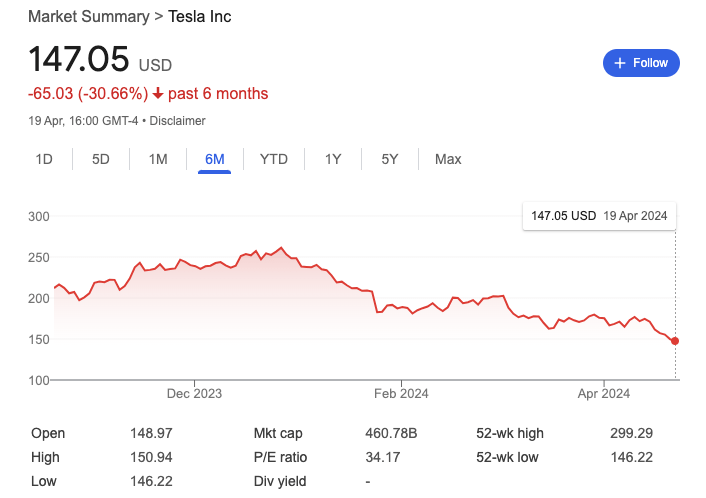

This decline extends further back, with Tesla’s stock value dropping a total of 31% in the past six months. Investor confidence is shaky due to these falling sales figures.

In China, Tesla has intensified its price cuts, slashing the prices of its latest Model 3 by nearly $2,000 (14,000 yuan), bringing its price to approximately $32,600 (231,900 yuan).

This aggressive pricing strategy is a response to mounting competition from Chinese rivals and a broader trend of price wars in the EV market.

Li Auto, Tesla’s nearest competitor in China, has also joined the fray by reducing prices on its vehicles by up to 5.7%. Li Auto’s price adjustments signify the expansion of the EV price competition into the premium segment, posing challenges for smaller players in the market.

The price reductions by Tesla come amidst a challenging period marked by declining sales and market pressures. In the US, Tesla has also slashed prices on its entire range, including the Model Y, Model S, and Model X.

Additionally, the price of its Full Self-Driving software was reduced from $12,000 to $8,000. These price cuts represent a significant departure from Tesla’s usual premium pricing approach, reflecting the company’s efforts to invigorate sales and encourage broader adoption of EVs.

Tesla’s challenges extend beyond pricing strategies, encompassing operational hurdles and market dynamics.

The company has faced production issues, including shifts in Model 3 manufacturing and a factory fire in Germany, which have hindered its ability to meet demand.

Furthermore, Tesla has had to recall all of its Cybertrucks due to a defect with the accelerator pedal, highlighting quality control challenges amidst rapid growth.

These challenges come at a time when competition is heating up. Established players like BYD, the world’s best-selling EV maker, and new entrants like Xiaomi with its competitively priced SUV7 are piling additional pressure on Tesla’s market share.

In addition to production setbacks, Tesla has experienced investor concerns and stock volatility. The company’s Q1 2024 sales hit a two-year low, leading to a steep decline in stock value. Investor confidence has been further shaken by the announcement of layoffs affecting over 10% of Tesla’s workforce and delays in key projects.

Dreams of a more affordable $25,000 electric car have been put on hold as resources are shifted towards developing a self-driving taxi service.

Furthermore, Elon Musk’s planned visit to India, which potentially held significance for Tesla’s expansion into the Indian market, has been delayed.

They had to recall all Cybertrucks due to a potentially dangerous issue with the control pedals where the floormat could slide under the brake and accelerator pedals, impeding their effectiveness.

Despite these challenges, Tesla remains a frontrunner in the global EV market, with a strong presence in China and the US.

The company delivered over 600,000 cars to mainland Chinese buyers in 2023, representing a 37% increase from the previous year.

However, both Tesla and its competitors, including Li Auto, suffered setbacks in the first quarter of 2024 as weak sentiment across the entire market dented deliveries. Tesla is at a crossroads.

The company’s once dominant position is being challenged, and its response has involved significant internal restructuring and price cuts. While the price cuts may boost sales in the short term, the long-term impact on Tesla’s profitability remains to be seen.

The company must navigate this period of intense competition, production issues, and investor wariness to regain its footing and ensure its future as a leader in the EV market.