China’s rise to the top of the electric vehicle (EV) industry is a story of remarkable transformation. Just a decade ago, the nation relied heavily on foreign expertise and technology.

Today, Chinese brands like BYD, SAIC Motor, and NIO hold the top spots in global EV sales, with China accounting for over half of all EVs sold worldwide in 2023. This success can be attributed not only to internal innovation but also to the strategic leveraging of competition from established foreign carmakers.

Learning from the Masters: A Knowledge Transfer Advantage

The Chinese government’s joint venture mandate, implemented in the 1980s, played a crucial role in this story. This policy required foreign automakers to partner with domestic companies to operate within the country. While seen as restrictive at first, it proved to be a strategic masterstroke.

These joint ventures acted as knowledge transfer platforms, offering Chinese companies invaluable insights into:

- Battery Technology: Partnering with giants like Panasonic, a leader in lithium-ion batteries, provided crucial knowledge in battery design, production, and management systems. Chinese companies like BYD used this knowledge to become major players in the battery industry, supplying not only for their own vehicles but also for other manufacturers globally.

- Powertrain Engineering: Collaboration with established carmakers like Volkswagen and General Motors allowed Chinese engineers to understand electric motor design, powertrain integration, and vehicle control systems. This knowledge laid the foundation for the development of efficient and reliable electric powertrains in Chinese vehicles.

- Manufacturing Efficiency: Partnering with experienced foreign manufacturers exposed Chinese companies to lean manufacturing practices, quality control standards, and efficient production processes. This knowledge helped them streamline their own operations and improve production efficiency.

Beyond Copying: Building on the Knowledge Base

However, Chinese companies didn’t just replicate foreign technology. They used the acquired knowledge as a springboard for further innovation, focusing on:

- Affordability: Recognizing the cost-sensitivity of the domestic market, Chinese manufacturers prioritized developing EVs at competitive price points. This strategy made EVs accessible to a wider audience, accelerating adoption rates.

- Government Support: China’s aggressive EV policies, including subsidies and tax breaks, provided significant financial resources for domestic companies to invest heavily in research and development (R&D). This fueled innovation in battery technology, motor design, and vehicle features.

- Vertical Integration: Unlike some foreign manufacturers reliant on external suppliers, Chinese firms like BYD invested heavily in building their own battery supply chains. This vertical integration gave them greater control over costs, quality, and innovation in the crucial battery technology sector.

Data and Statistics Highlighting the Shift:

- In 2010, China’s share of the global EV market was a mere 1.1%. By 2023, this figure skyrocketed to over 53%, according to the International Energy Agency (IEA).

- In 2012, only 35,000 EVs were sold in China. By 2023, this number had surged to over 5.67 million, according to the China Association of Automobile Manufacturers (CAAM).

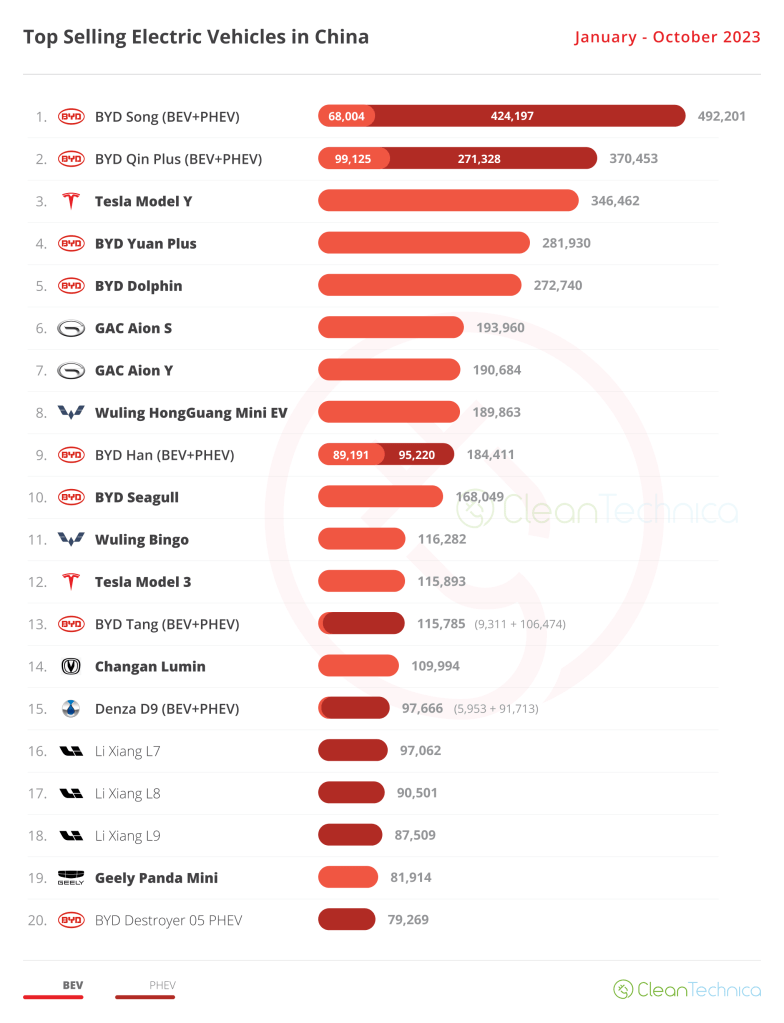

- While foreign brands like Tesla held the top spots in the early years of the Chinese EV market, Chinese brands now dominate the sales charts. In 2023, BYD alone sold over 1.86 million EVs, followed by SAIC Motor and SGMW, both Chinese brands.

The Competition Continues: A Win-Win for the Future

The forced collaboration with foreign automakers might have ended, but the competition in the Chinese EV market continues. This ongoing rivalry presents exciting opportunities for both consumers and the industry:

- Intensified R&D: As both domestic and foreign players vie for market share, they will be pushed to innovate faster, leading to breakthroughs in battery technology, charging infrastructure, and range improvements.

- Wider Market Choices: Consumers will benefit from a broader selection of EVs with diverse features, performance levels, and price points, catering to a wider range of needs and preferences.

- Global EV Dominance: The intense competition in China could spill over to the global market, accelerating the overall transition towards EVs and ultimately leading to a cleaner transportation future for the world.

China’s EV leadership is a testament to the power of strategic competition and leveraging knowledge transfer. By combining this advantage with internal innovation, government support, and a focus on affordability, China has built a formidable EV industry. As competition continues to drive innovation, the future holds immense promise for advancements in EV technology and ultimately a cleaner transportation future for all.