Beijing, China – April 17, 2024 – Japanese automakers, once dominant forces in China, are scrambling to adapt to the country’s aggressive push towards electric vehicles (EVs). Honda’s launch of its third EV brand, Ye (烨), exemplifies this struggle.

China’s auto market, the world’s largest, is undergoing a dramatic shift. Battery Electric Vehicles (BEVs) are experiencing explosive growth, accounting for a significant portion of total vehicle sales. In 2023, estimates suggest BEVs comprised close to 40% of China’s new car market, a staggering number compared to other regions. This surge is driven by government incentives, growing environmental awareness, and a growing selection of compelling domestic EV offerings.

This rapid EV adoption has come at the expense of traditional Internal Combustion Engine (ICE) vehicles. Their market share has shrunk considerably, with forecasts suggesting they could fall below 50% of total sales by 2025.

Honda, along with other Japanese brands, has been slow to embrace this EV revolution. Their traditional strength in China relied heavily on ICE vehicles. Now, they face an uphill battle against established domestic EV players and even Western Tesla.

Honda’s new Ye brand is a direct response to this changing landscape. By creating separate EV brands like e:N, Lingxi, and now Ye, Honda aims to cater to different segments of the Chinese EV market with focused offerings. Each brand utilizes dedicated platforms and design languages to appeal to specific customer preferences.

“The Ye brand is designed to meet the evolving needs of Chinese customers,” said a Honda spokesperson at the launch event. The new brand will utilize a dedicated electric vehicle platform called Architecture W for its upcoming models.

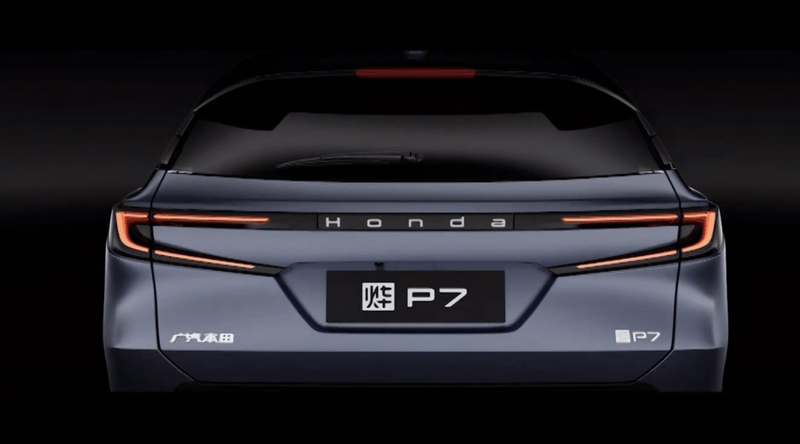

Honda leverages its existing partnerships in China to bolster its EV strategy. The Ye P7, expected in late 2024, will be built by GAC Honda, a joint venture between Honda and GAC Group. The Ye S7, also arriving by year-end, will roll off the production lines of Dongfeng Honda, another joint venture with Dongfeng Motor. This collaboration allows Honda to benefit from established manufacturing expertise and navigate China’s complex automotive market.

Despite these efforts, Japanese brands still have a long way to go to regain their former dominance. Other Japanese brands are also taking action. Toyota has partnered with BYD, a leading Chinese EV maker, to develop electric vehicles. Nissan has launched its own EV brand in China called Venucia e-Power.

The success of Ye, with its ambitious goal of six models by 2027 and full electrification in China by 2035, will be a key indicator of whether Honda can catch up with the fast-moving Chinese EV market.