Chery and MG Sparks Price War in Malaysia’s Booming EV Market

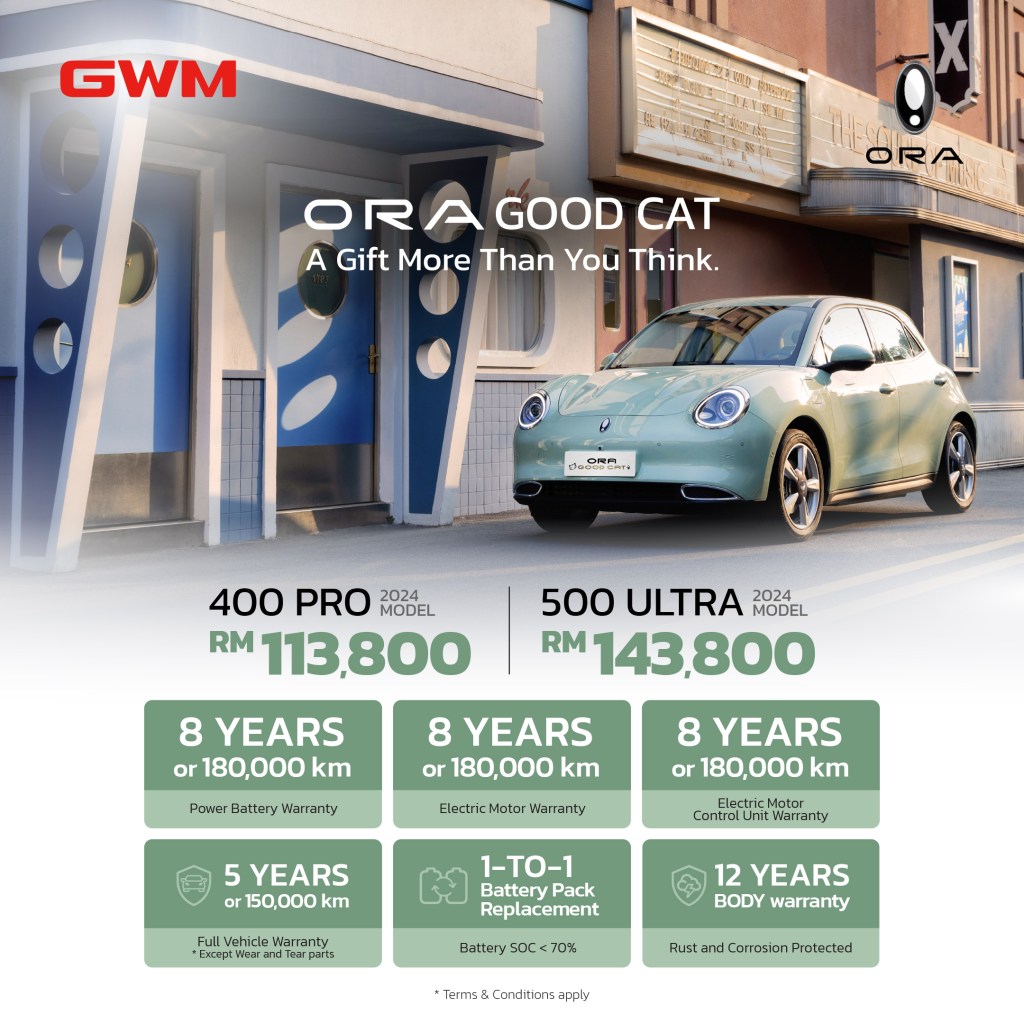

The recent move by BYD to drop the price of their Atto 3 by RM20K has prompted Great Wall Motors to follow suit, slashing nearly 20% off the price of the Ora Good Cat, now starting at a very attractive price of RM113K.

The launch of the Chery Omoda E5 and MG at highly competitive prices in Malaysia has ignited a price war in the country’s electric vehicle (EV) market, reflecting a global trend seen in China itself. This price competition is a boon for Malaysian consumers, offering them a wider range of EVs at more attractive price points.

The MG 4 stormed onto the market with a starting price of RM104K for the base model, topping off at RM159K for the high-performance model.

Chery’s Omoda 5 intensified the competition further by tempting Malaysian buyers with an impressive 430 km range on a single charge, a brisk 0-100 km/h acceleration time of 7.6 seconds, and a competitive price tag of RM146,800 (on-the-road).

Malaysia’s EV market pioneer, BYD, wasted no time and dropped the prices of their popular Atto 3 compact crossover by RM20,000. The 2023 model year Standard Range variant now starts at RM129,800.

Competing with the Omoda 5’s impressive range of 430 km at RM146,800 would have made the Atto 3’s lower 345 km range difficult to swallow, even among budget-conscious buyers.

GWM, another Chinese automaker with an early presence in Malaysia, wasn’t about to be left behind. The company announced a significant RM26,000 price cut across its entire Ora Good Cat lineup.

This aggressive move positions the Ora Good Cat, priced between RM114,500 and RM144,500 (on-the-road) depending on the variant, as the most affordable option among the three.

Prior to the launch of MG and Omoda E5, Tesla brought a price war to Malaysia by offering the Model 3 with a starting price of RM189K, while the Model Y entered the fray with a price tag of RM199K.

However, Chinese brands may have felt that they are not quite competing in the same segments and held on to their prices, but their price positioning became indefensible once new brands entered the market with pricing intent on dominating.

Beyond Price: Specification Showdown

While price is a significant factor for many car buyers, specifications also play a crucial role in the decision-making process. Here’s a closer look at how the Omoda E5, Atto 3 (Standard Range), and Ora Good Cat stack up against each other in key areas:

Range: Chery Omoda E5 (430 km) takes the lead, followed by BYD Atto 3 (345 km) and Ora Good Cat (420 km for the higher-range variant).

Performance: All three offer comparable acceleration times, with the Omoda E5 posting a slight edge at 7.6 seconds.

Price: Ora Good Cat emerges as the most affordable option, followed by the BYD Atto 3 (with the discount) and then the Chery Omoda E5.

Features: BYD Atto 3 boasts Level 2 semi-autonomous driving capabilities, a feature absent in the other two contenders. The Ora Good Cat is currently offering a free AC wallbox charger and portable charger for a limited time.

EV Price Wars: A Global Phenomenon

The price war in Malaysia is simply a reflection of a larger trend unfolding across the globe. The EV market is experiencing rapid growth, and China, a global leader in EV production and sales, saw the first price war.

China has more than 50 EV brands, operating in a market that has traditionally been very competitive. The rise of EVs has given local brands a significant edge over imports in terms of technology and general product appeal.

The local EV advantage has significantly eroded the market share of foreign brands, who are facing decline in their ICE market while having no competitive product to offer in the burgeoning EV sector.

This has led to an aggressive price war among domestic brands as they fight over the new market that doesn’t seem to have any foreign competition, except for Tesla.

BYD even dropped the prices of their entry-level hybrids to make them more affordable than entry-level ICE cars, signaling an aggressive effort to cull ICE sales and accelerate the transition to electric in the world’s biggest car market.

This trend is expected to continue as competition intensifies, production scales up, and China domestic brands enjoy more significant economies of scale.

Given the high concentration of the EV supply chain in China, their manufacturers not only enjoy price competitiveness but potentially more agility as well, as they can source the latest technology parts and components before they leave the country.

An obvious example is the current dominance of Lithium Iron Phosphate (LiFePo) batteries, which remained as a China-exclusive component until Tesla built GigaShanghai and began exporting cars powered by these batteries.

As traditional carmakers struggle to put EVs to market that are profitable, new players like Tesla and BYD are moving forward with vertically integrated manufacturing that affords them high agility in terms of product improvement and development, as well as being a technological moat that is not easy for the competition to cross.

Malaysian Consumers Reap the Benefits

The price war triggered by the Chery Omoda E5’s arrival is undoubtedly positive news for Malaysian consumers. They now have a wider selection of EVs to choose from, with features and specifications that cater to diverse needs and budgets. The Omoda E5’s compelling combination of range, performance, and price has forced established players to become more competitive, ultimately leading to a more dynamic and consumer-centric EV market in Malaysia.

While the price war is a welcome development for Malaysian consumers, it’s crucial to consider all factors, including range, performance, features, and after-sales service, before making a final decision.

One thing is certain: the EV market in Malaysia is experiencing a period of exciting growth, with Chinese carmakers playing a leading role. This competition can only benefit consumers in the long run, as they are presented with a wider variety of EVs at increasingly competitive prices.