While some automotive industry observers think that the decision by Germany and France and maybe other European countries to remove or reduce subsidies for battery electric vehicles (BEV) is not beneficial to the new technology, we think the opposite.

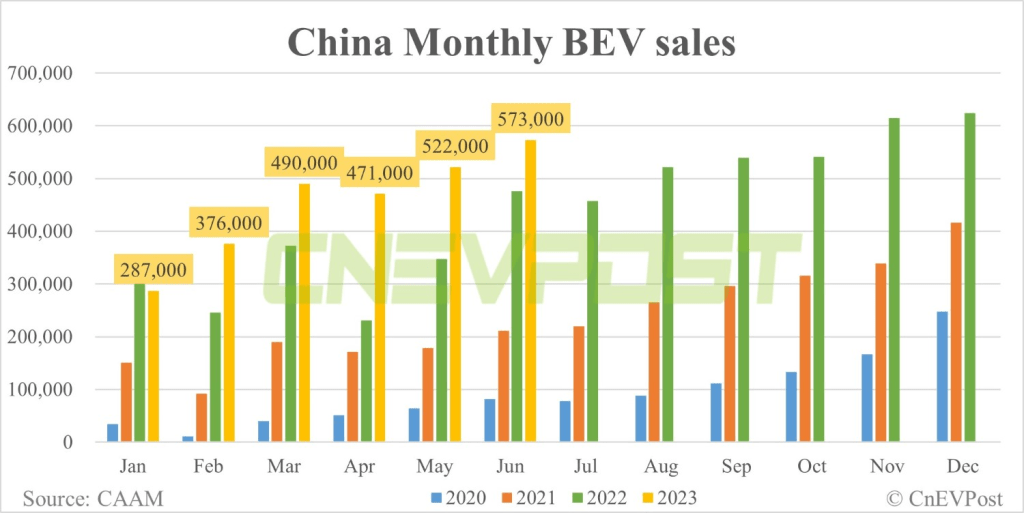

At the start of 2023 we saw a major dip in the sales of EV in China as the government stopped their incentive programmes but the market recovered swiftly and by February, the numbers began to eclipse 2022 figures.

While the removal of incentives rocked the market, buyers in China was already familiar with the benefits of EVs and by the end of 2022, the biggest auto market in the world had gove well past the technology adoption curve inflection point for BEVs.

With sufficient market momentum, sales numbers were able to overcome the removal of incentives and continue to make headway into the overall autmotive market in China.

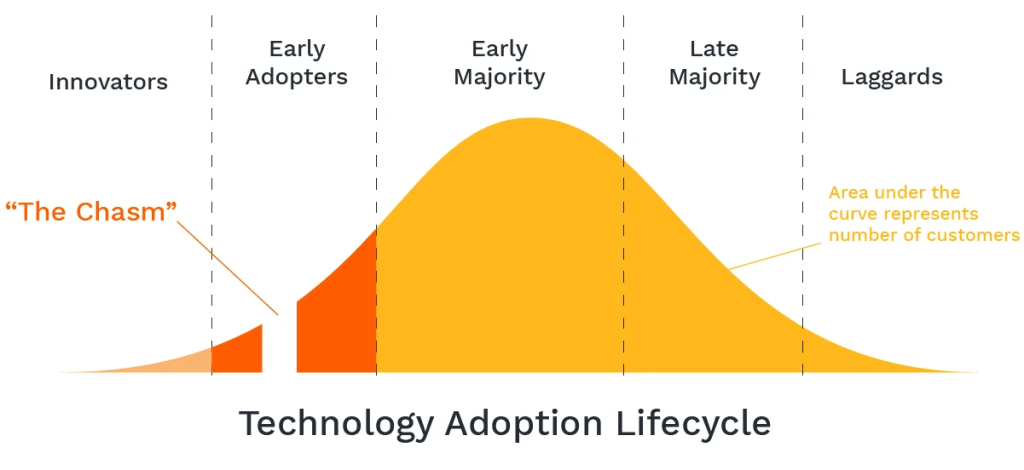

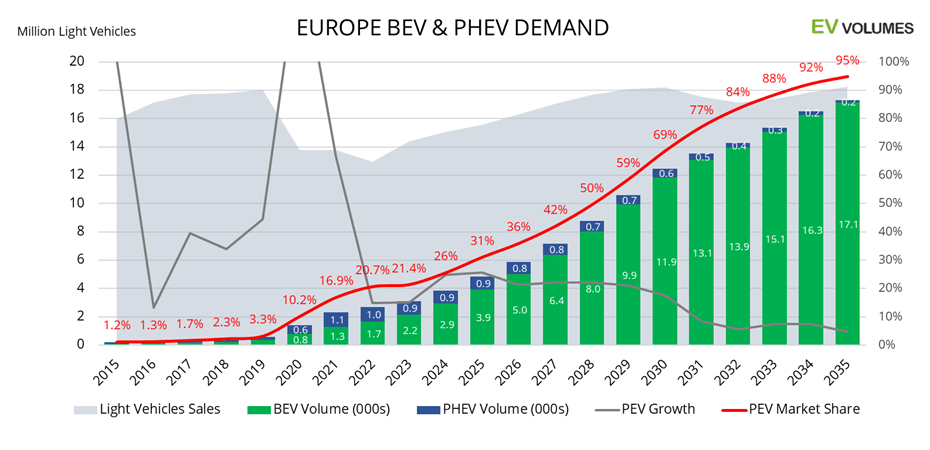

When looking at the global context we have to realise that in December 2023, global BEV sales hit 15 per cent of industry total, putting just slightly beyond the inflection point.

This indicates that the market is preparing itself for the jump from early adopters to early mass market acceptance, for most governments this is roughly the right time to pull back on incentives as the technology becomes accepted by volume buyers.

Globally 14.1 million BEVS were sold last year out of a total of 86.8 million vehicles, this represents 16.2 per cent of the total market, putting the world in the inflection zone.

The decision by governments to discontinue electric vehicle (EV) incentives heralds a positive shift, as it compels EV manufacturers to expedite cost reduction measures, ultimately fostering true market parity.

This cessation of incentives eliminates excuses for both internal combustion engine (ICE) and EV manufacturers to attribute their relative success or failure to subsidies.

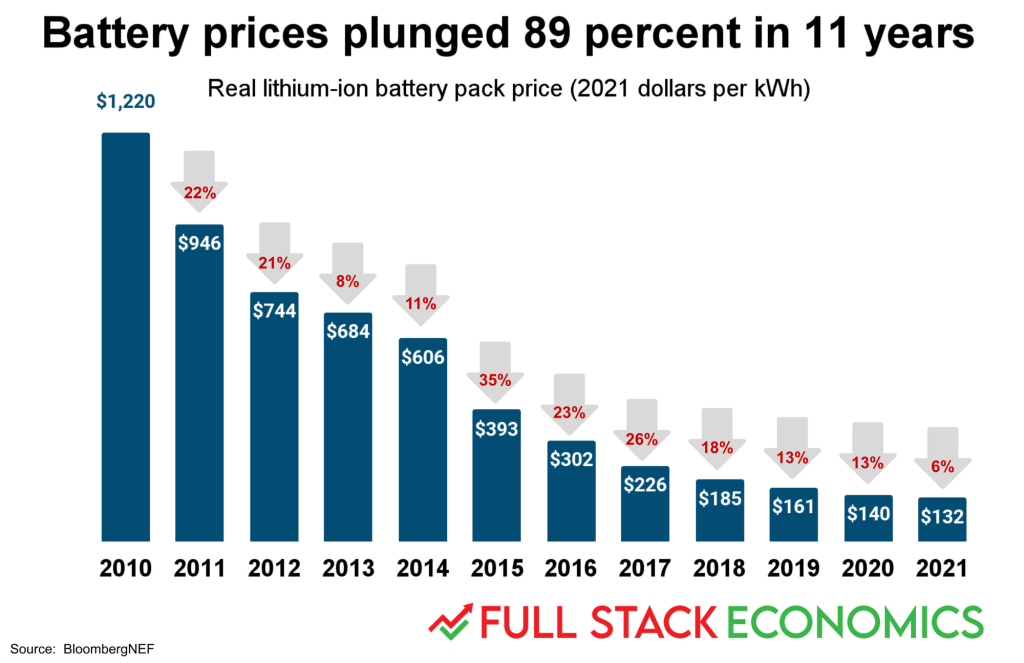

Furthermore, the decreasing cost of key EV components, notably batteries, underscores a compelling trend towards affordability and widespread adoption.

Recent years have witnessed a remarkable decline in battery prices, driven by advancements in technology, economies of scale, and increased competition among manufacturers.

For instance, between 2010 and 2020, lithium-ion battery prices dropped by approximately 89%, according to BloombergNEF.

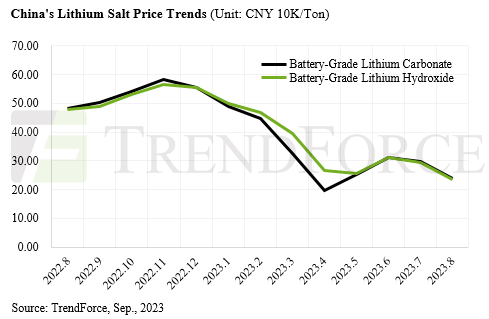

Moreover, the price of batteries is projected to halve from 2020 to 2025, with data from China indicating that this reduction may occur as early as this year. This trend suggests that EVs are steadily approaching cost competitiveness with traditional ICE vehicles, particularly as battery costs continue to decline.

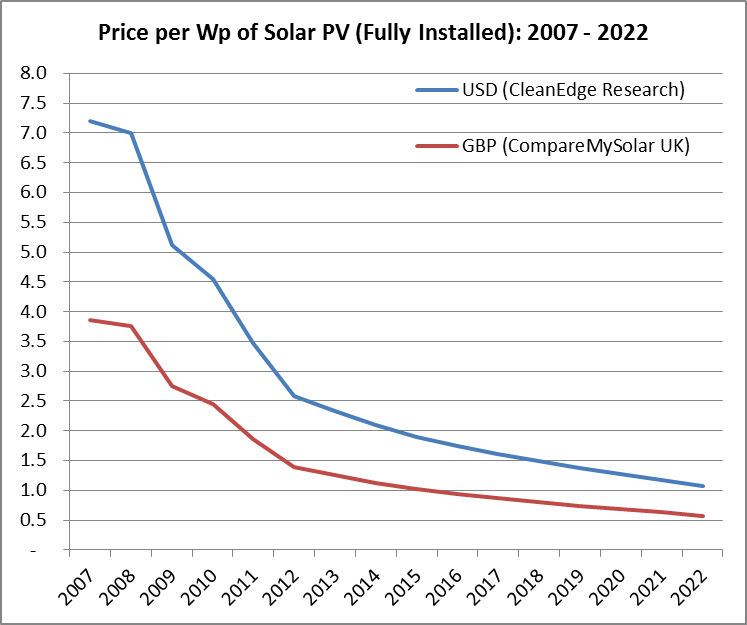

Additionally, the rise of renewable energy sources, especially solar power, presents a significant opportunity to further enhance the economic viability of EVs.

The proliferation of solar energy, coupled with declining costs, promises to mitigate concerns regarding the environmental impact of EV production and operation.

According to the International Renewable Energy Agency (IRENA), the cost of solar PV electricity has plummeted to as low as 2 cents per kWh in some regions, making it an increasingly attractive option for powering EVs.

Furthermore, the integration of solar power into the transportation sector can potentially alleviate pressure on grid infrastructure and reduce reliance on fossil fuels.

Moreover, the growth of renewables, particularly solar and wind power, has catalyzed the development of grid-scale battery storage solutions.

Grid batteries play a crucial role in enabling the efficient storage and utilization of renewable energy, addressing the intermittency and variability inherent in solar and wind generation.

These batteries store surplus energy during periods of high generation and release it during peak demand, enhancing grid stability and reliability.

The widespread deployment of grid batteries not only facilitates the integration of renewables but also contributes to decarbonizing the energy sector and reducing greenhouse gas emissions.

With the convergence of compelling energy economics and declining EV prices, devoid of incentives, the market dynamics are poised for a fundamental shift.

The absence of subsidies necessitates that EV manufacturers innovate and optimize their production processes to remain competitive. Moreover, consumers are likely to base their purchasing decisions on the genuine cost-effectiveness and performance of EVs, rather than relying on government incentives.

In this context, the market will serve as the ultimate arbiter, determining the success of EV technology based on its merits and real-world performance.

The most superior technology, characterized by affordability, efficiency, and sustainability, is poised to emerge victorious in this new landscape.

As such, the discontinuation of EV incentives represents a pivotal moment in the evolution of the automotive industry, where innovation and market forces converge to drive meaningful change.