Subaru Corporation is an outlier among traditional automakers because it consistently posts strong profits and market growth despite having only a few models in its line-up.

Focusing on producing unique vehicles with strong brand character has paid off for the Japanese carmaker and now it feels confident enough to put aside 40 billion yen to execute shares buyback.

The company said that it has so far spent 21 billion yen to purchase 8,541,600 shares.

The board had approved the shares buyback programme back in May 11 and the company has until the end of September 2023 to execute.

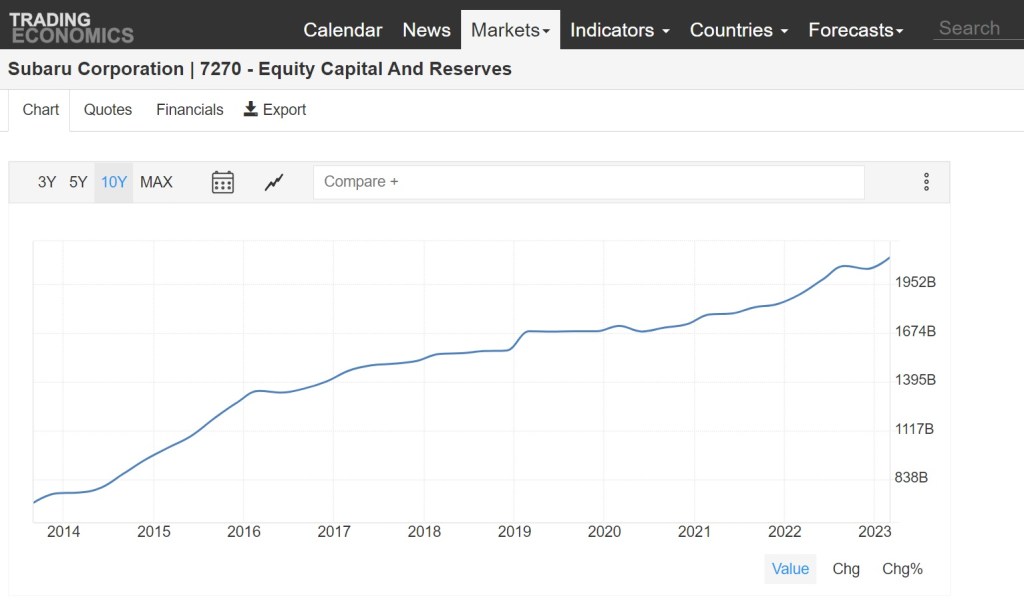

While there is no doubt that the company’s financials are on solid ground at the moment with market capitalisation 2.12trillion yen when compared to debt of 3.93 billion yen

It also has a significant cash and short term investments of 1.3 trillion yen and 973.385 billion yen in actual cash.

Subaru’s total debt for fiscal years ending March 2019 to 2023 averaged 2.934 billion. Subaru’s operated at median total debt of 3.217 billion from fiscal years ending March 2019 to 2023. Looking back at the last 5 years, Subaru’s total debt peaked in March 2021 at 3.933 billion.

While Subaru is healthy at the moment, the company does not have any significant presence in the electric vehicle market with only the Solterra SUV, which is a joint effort with Toyota being the sole representation in what is considered the future of the automotive market by the majority of analysts.

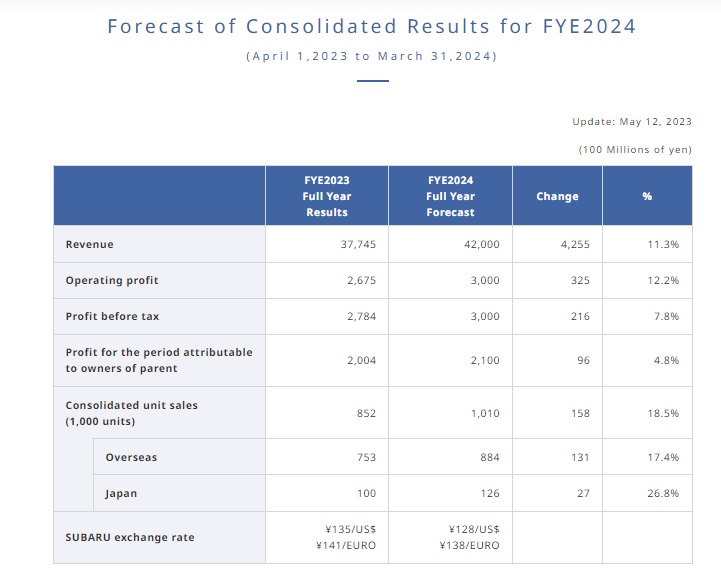

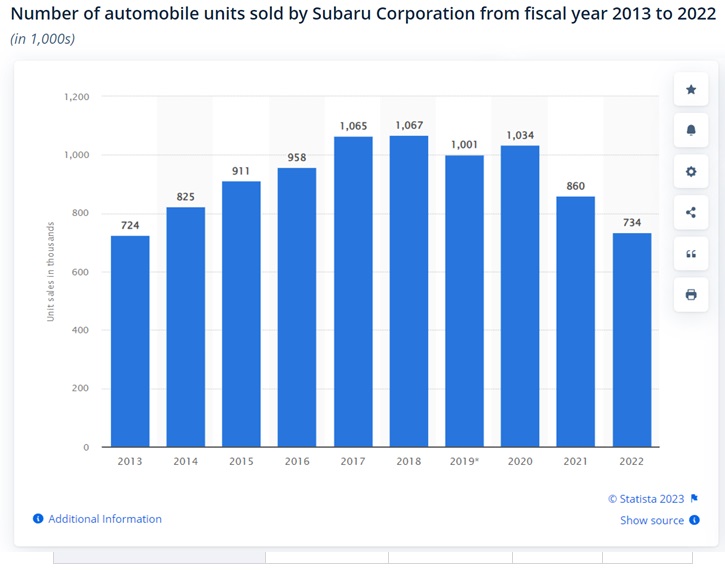

Their sales number also peaked in 2018 at 1.067 million vehicles and like many carmakers say significant downturn during the pandemic but they have reversed that trend for their financial year 2023 rising from 734,000 units in 2022 to 852,000.

The company expects to sell 1.01 million vehicles in FY2024.

Subaru plans to invest more than 1 trillion yen (USD7.4 billion) to produce up to 300,000 BEVs in its own factory by 2030.

This can be considered as a conservative amount given the numbers being bandied by the other carmakers but for Subaru, which typically do not produce many models this may be a good amount for bringing their own battery electric vehicles to market.

However , since other carmakers seem to be struggling with their efforts to come up with competitive BEVs and an uncertain market for internal combustion engine vehicles, some may suggest that Subaru should keep the cash for contingencies during this period of transition.