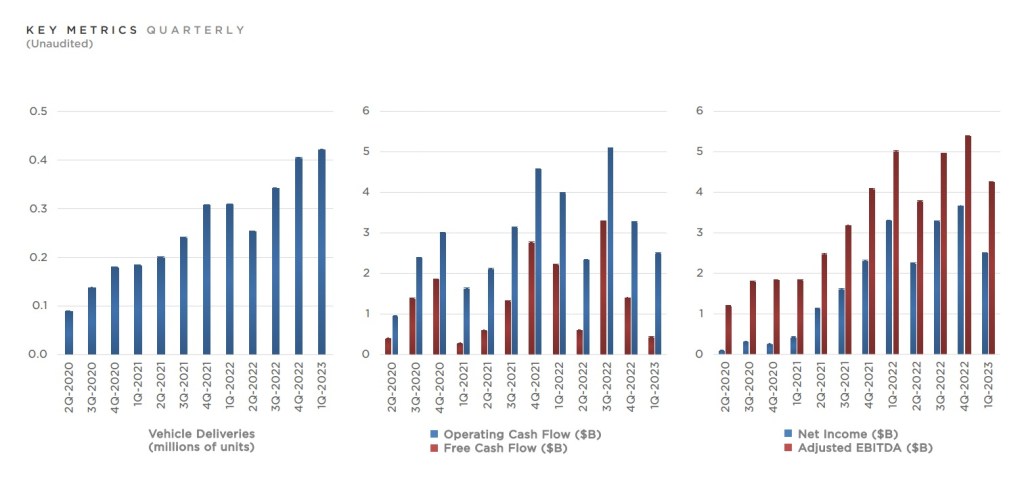

Company reports GAAP operating income of $2.7 billion and net income of $2.5 billion

- Tesla reports strong Q1 financial results, with GAAP operating income of $2.7 billion and net income of $2.5 billion

- The company’s financial performance was boosted by growth in vehicle deliveries and other parts of the business

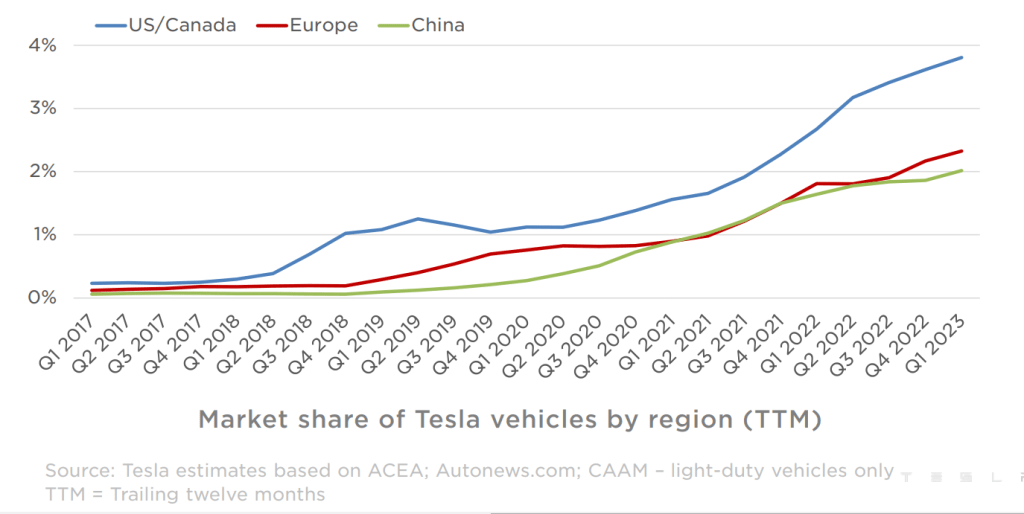

- Tesla’s Model Y was the best-selling vehicle in both Europe and the US in the first quarter, excluding pickups

- The company is focused on ongoing cost reduction of its vehicles, including improved production efficiency and lower logistics costs, while scaling operations

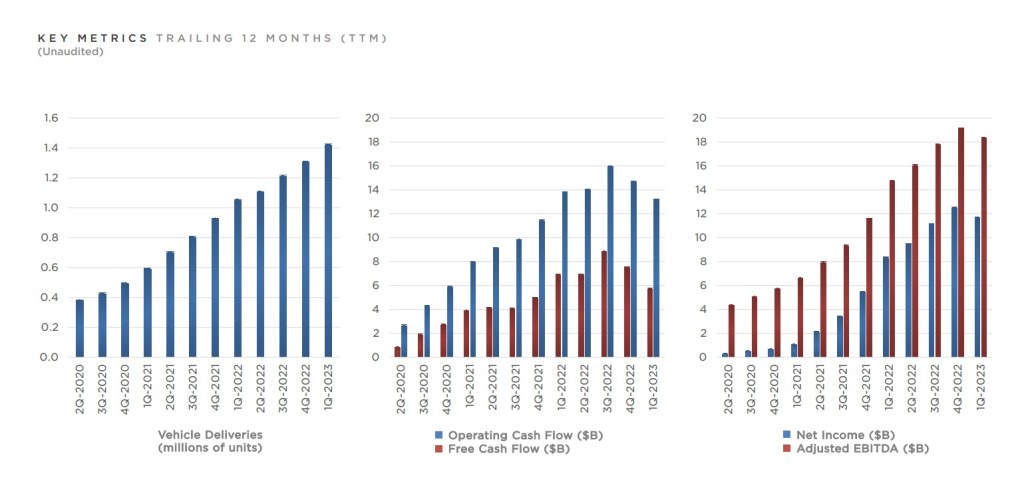

- Tesla plans to grow production as quickly as possible in line with the 50% CAGR target set for early 2021

Tesla, the electric carmaker, has reported its financial results for the first quarter of 2023, and the numbers are strong. The company reported a GAAP operating income of $2.7 billion and an operating margin of 11.4%. The net income was $2.5 billion on a GAAP basis and $2.9 billion on a non-GAAP basis. This comes as a positive sign, as Tesla had faced challenges in meeting production targets in the past, and had also seen a decline in demand in some markets.

Tesla’s financial performance was boosted by growth in vehicle deliveries and other parts of the business, despite reduced average selling prices YoY. The company also reported a positive cash flow, with operating cash flow of $2.5 billion and free cash flow of $0.4 billion, after excluding stock-based compensation. Tesla’s quarter-end cash, cash equivalents and investments increased sequentially by $217M to $22.4B in Q1, driven mainly by free cash flow of $441M, partially offset by other financing activities, including debt repayments.

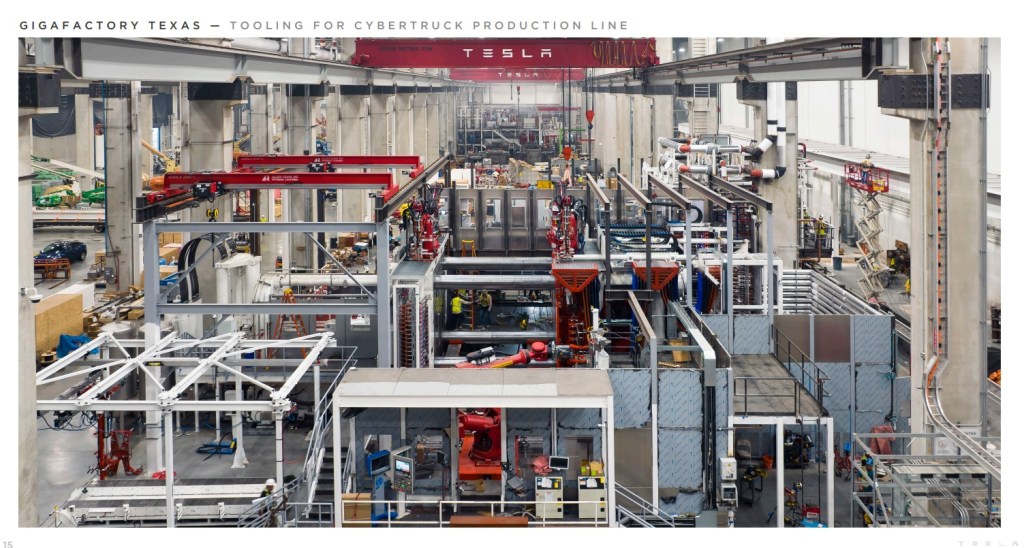

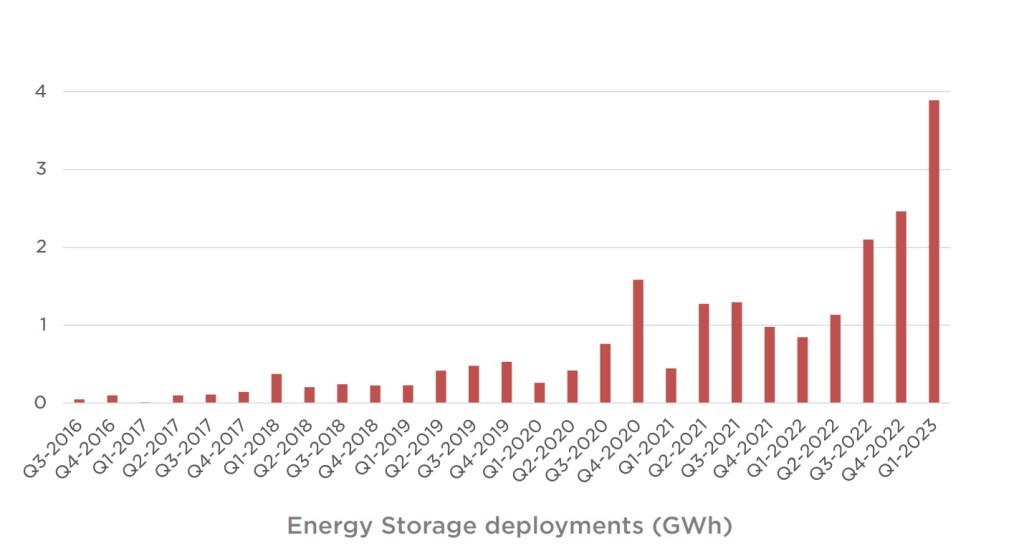

Tesla’s Model Y was the best-selling vehicle in both Europe and the US in the first quarter, excluding pickups. The company’s Cybertruck factory tooling is on track and producing Alpha versions, and Tesla is rapidly growing energy storage production capacity at its Megafactory in Lathrop. Tesla also announced a new Megafactory in Shanghai, as part of its ongoing efforts to expand its production capacity.

In the first quarter, Tesla implemented price reductions on many vehicle models across regions, but the company’s operating margins reduced at a manageable rate. Tesla is focused on ongoing cost reduction of its vehicles, including improved production efficiency at its newest factories and lower logistics costs, while scaling operations. The company also expects its product pricing to continue to evolve, depending on a number of factors.

Tesla remains focused on rapidly growing production, investing in autonomy and vehicle software, and remaining on track with its growth investments. The company’s near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity, and service. Tesla believes that pushing forward in the current macroeconomic environment will lay a proper foundation for the best possible future.

Production

Tesla produced a record number of vehicles in Q1, thanks to ongoing ramps at its factories in Austin and Berlin. The company aims to reduce the percentage of vehicles delivered in the third month and smooth out deliveries throughout the quarter to reduce cost per vehicle, while increasing in-transit inventory at the end of each quarter. The Model Y was the best-selling non-pickup vehicle in the US in Q1, while equipment installation for Cybertruck production at Gigafactory Texas continued in Q1 and remains on track.

Tesla’s Shanghai factory has been running near full capacity for several months, so the company does not expect a meaningful increase in weekly production run rate. The company launched sales in Thailand, which has had a very positive reception. Giga Shanghai remains Tesla’s main export hub. In Germany, the Model Y production line produced over 5,000 vehicles in a week towards the end of Q1. The Tesla Model Y became the best-selling vehicle in Europe in Q1-2023, of any kind, according to IHS and other latest available data.

Core Technology

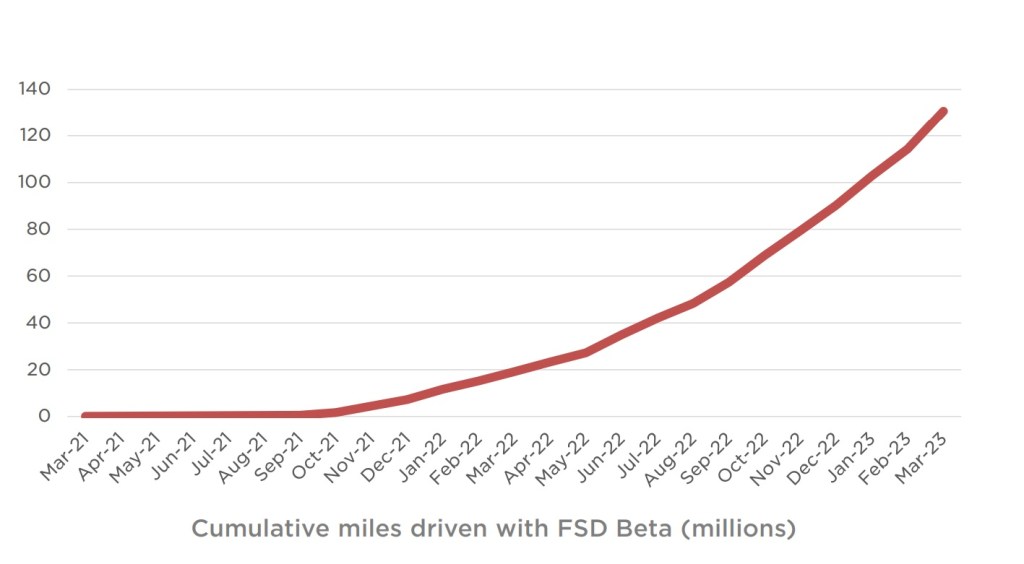

Tesla’s Q1 report highlights several key points regarding the company’s core technology. The report notes that Tesla’s Autopilot and Full Self-Driving (FSD) features continue to expand, with over 150 million FSD Beta miles driven to date. Tesla emphasizes the importance of collecting diverse datasets for its AI-based approach to scalable autonomy.

In addition, Tesla notes that its software experience is best-in-class across all its vehicles, with ongoing software updates bringing new functionality over time. Tesla has also launched home-grown Recruitment and Employee Health & Safety platforms as part of the broader Tesla OS ecosystem.

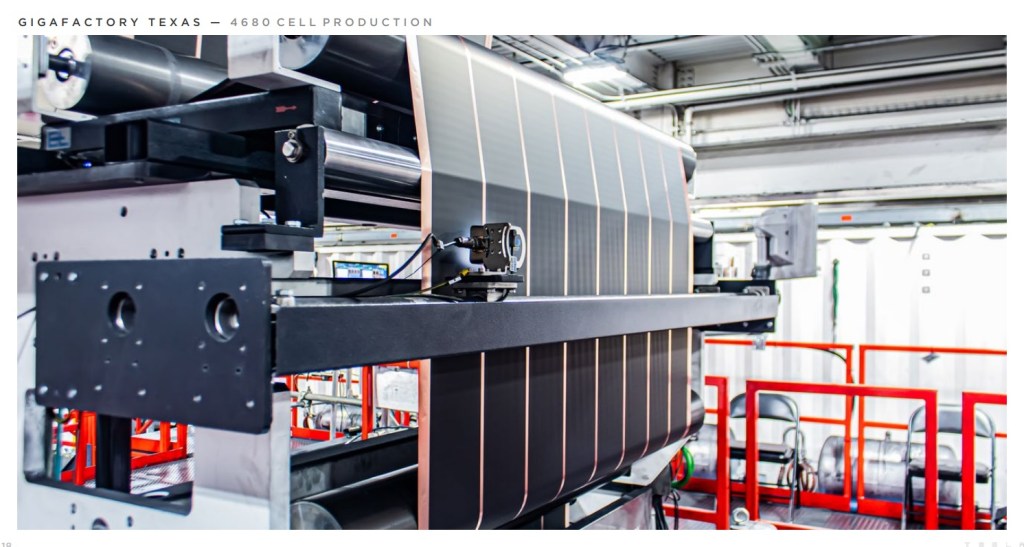

Regarding battery, powertrain, and manufacturing, Tesla is focused on producing electric vehicles profitably, which requires rethinking how vehicles are designed and produced. The company plans to transition to a 48 Volt architecture for vehicle electronics, increase the penetration of in-house designed controllers, and introduce cheaper, more scalable drive units to reduce costs.

The report emphasizes Tesla’s commitment to technology innovation and cost reduction, with a particular focus on expanding its autonomous driving capabilities and improving its manufacturing processes.

Energy Storage

In Q1, Tesla achieved record energy storage deployments of 3.9 GWh, a 360% YoY increase, thanks to ongoing Megafactory ramp. Solar deployments increased by 40% YoY to 67 MW but declined sequentially due to volatile weather and supply chain challenges.

Tesla’s Services and Other division reported all-time high revenue and gross profit, with strong YoY growth of used vehicle sales and Supercharging. In terms of core technology, Tesla’s FSD Beta users have driven over 150 million miles, and the company believes that mass collection of diverse datasets is essential for AI-based approach to scalable autonomy.

Cost reduction remains the main enabler for delivering on Tesla’s mission, and the company plans to transition to 48 Volt architecture for vehicle electronics, higher penetration of in-house designed controllers, cheaper, more scalable drive units and further innovations in the manufacturing process.

Outlook

Tesla plans to grow production as quickly as possible in line with the 50% CAGR target set for early 2021. In 2023, they expect to produce around 1.8 million cars, staying ahead of the long-term growth target. The company also has sufficient liquidity to fund long-term expansion plans and maintain a strong balance sheet. Tesla expects hardware-related profits to be accompanied by an acceleration of software-related profits. The company plans to begin production of the Cybertruck later this year and continues to make progress on their next-generation platform.