Strong demand for BYD Atto 3 may have forced a rethink and move faster towards EV

In a briefing with journalists yesterday, Chery announced its plans to introduce its Omoda electric vehicle (EV) to Malaysia by Q3 or the end of 2023 at the latest.

The company initially announced the Omoda internal combustion engine (ICE) and hybrid versions, along with the Tiggo 8 model, as the first to enter Malaysia. However, with the success of BYD in getting 1000 orders in just 10 days in Malaysia, Chery may have felt pressure to bring its EV to the market sooner.

According to Chery International Executive Vice President, Charlie Zhang The Omoda EV will likely enter start of production in September in China, with the Malaysian introduction after that date, taking into account time needed for homologation and testing for the market.

He said the earliest it could happen would be in Q3 however if that is not possible they would like to introduce the vehicle before the end of 2023.

Zhang said the company is in the final stages of confirming a production partner in Malaysia for the Tiggo 8 and Omoda ICE variants. While they did not mention the name of the partner or manufacturing location word is that it would be up North.

Interestingly Zhang also said that they are keen to introduce Plug in Hybrid Electric Vehicles (PHEV) to Malaysia and suggested that they may be producing versions that have over 100km in pure electric range.

He said this would allow most Malaysians to enjoy EV driving almost completely during their daily commute. According to data, the average Malaysian drives around 70-80 kilometres a day.

However he did concede that the plan to introduce PHEV with big batteries will require much more detailed study, including incentives that they may be able to score to make it a viable product.

At this moment BEVs enjoy total import duty and road tax exemptions while hybrids are no longer drawing such support from the Government.

Zhang said pricing and product differentiation will be the key for introducing PHEVs into the market.

So far only premium brands are offering PHEVs in Malaysia due to the higher cost and complexity of the twin power plant arrangement while Chery is likely to price their products competitively against similar products from Japan and Korea, which would likely price them out of the PHEV market.

Speaking on broader terms, Chery share with Malaysian journalists their plans to move headlong into the EV space and will start production of two new models this year.

The two models are a luxury sedan and a large SUV, both with a range of up to 800km.

The sedan features the latest battery technology, connectivity, and user interface. It has a slippery design with a coefficient of drag of 0.21, airline-style reclining rear seats, and a configurable center console that slides forward and back.

The SUV has a more conventional and boxy design, but with clean modern detailing.

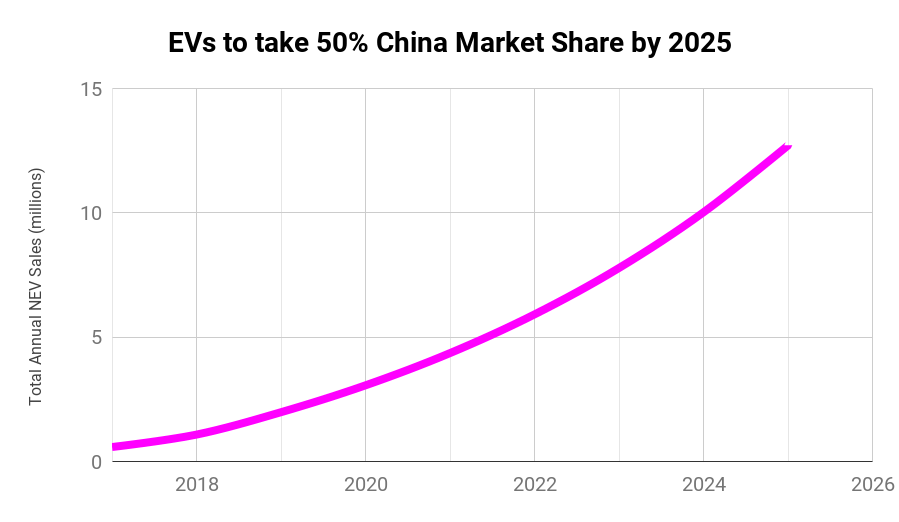

When asked about the China EV market, Zhang believes that the market will consist of 50% BEV by 2025 and approach near saturation point of 75% BEV by 2030.

This is an aggressive timeline but certainly in line with current trends where China’s total car sales now consist of 10% electric vehicles and is likely to increase by at least 50 per cent this year.

According to Zhang it is now quite rare to find a Chinese buyer who is not thinking of buying a battery electric vehicle for their next purchase.

“If you say that your next vehicle will be an ICE car, people might look at you strangely as someone who is backwards,” he added.

Earlier Zhang had showed videos of the new EV in digital rendering form and also the new factory which will build it, the factory is highly automated and looks like it could be a completely jigless factory.

They are also pouring money and manpower into chip design, which the company believes will be very important in the future as cars become more defined by their software and usability.

His view chorus those who say that the automobile industry is about to be disrupted by a wholesale change in the way that cars are consumed – as it transitions from being a mere mode of transportation into a mobile living space with multi functionality and connectivity.

He also believes that autonomy may become a key service in the future with owners choosing to subscribe to the capability for a determined period of time when it is useful and turning it off when they do not need it.

Chery is a significant player in the EV market in China, but it is not one of the biggest players.

According to data from the China Association of Automobile Manufacturers, Chery sold over 67,000 new energy vehicles, including both pure electric and plug-in hybrid models, in 2020, which placed it in the top 20 among all Chinese automakers.

However, it lags behind companies like BYD, SAIC, and GAC, which sold over 100,000 new energy vehicles each in 2020. Nonetheless, Chery has been investing in EV technology and is expanding its product lineup to capture a greater share of the growing EV market in China.

Achieving Level 4 autonomy by 2024 is an ambitious goal for Chery, but it is not impossible.

Several major automakers and tech companies are also working to achieve Level 4 autonomy in the next few years, and Chery has been investing heavily in autonomous driving technology.

However, it is important to note that Level 4 autonomy is a significant technological challenge, and there are many regulatory and safety considerations that must be addressed before fully autonomous vehicles can be deployed on public roads.

It remains to be seen if Chery can meet its goal of achieving Level 4 autonomy by 2024, but the company’s investment in the technology is a positive sign for the future of autonomous driving.