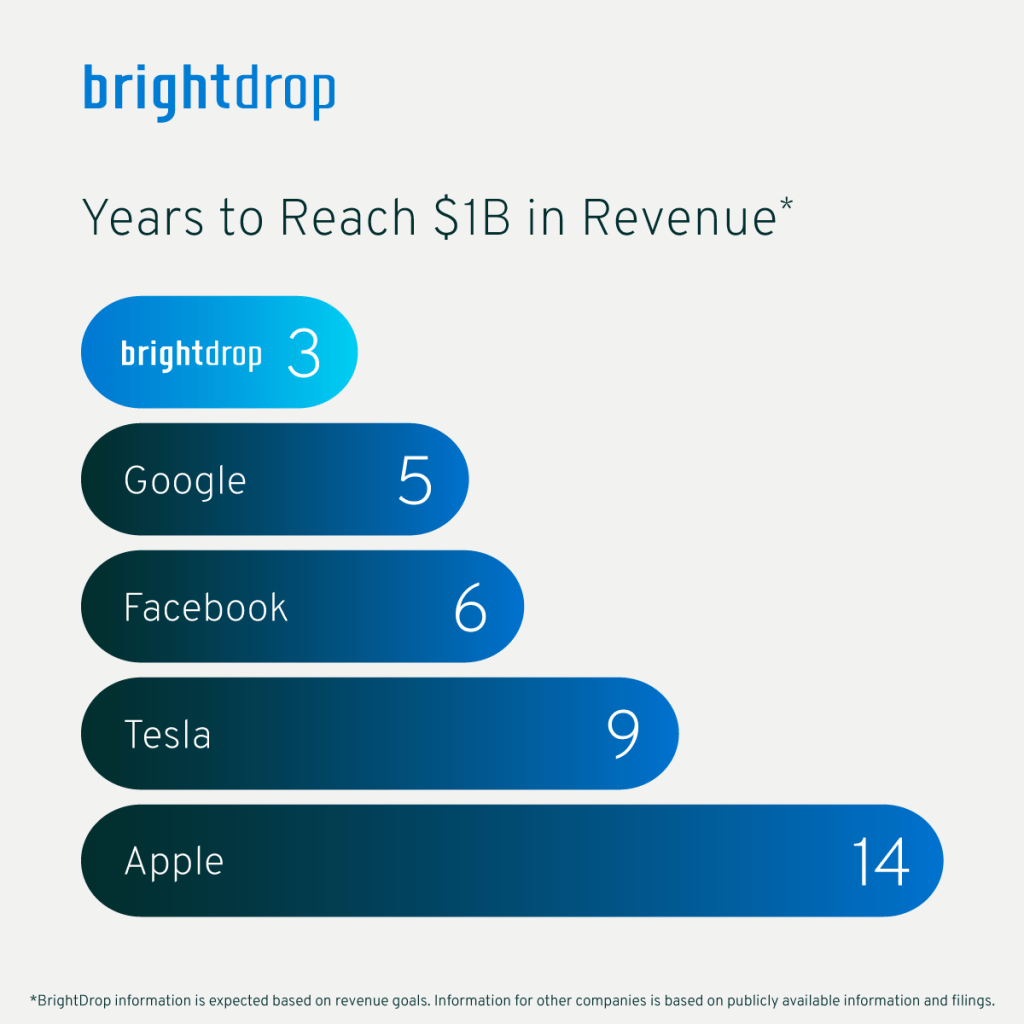

BrightDrop, a subsidiary of General Motors, has announced that it is on track to reach $1 billion in revenue by 2023, making it one of the fastest companies to ever reach this milestone.

The company, which launched in 2021 with a suite of products for last mile delivery and fulfillment, including electric delivery vans, eCarts, and a software suite, confirmed that it is set to generate up to $10 billion in revenue and reach 20% profit margins by the end of the decade.

BrightDrop has already received over 25,000 reservations and letters of intent from major companies including Walmart, Hertz, FedEx, and Verizon, and its products are already in use on the road.

The company also unveiled BrightDrop Core, a subscription-based software platform that combines data from its Zevo and Trace products to provide customers with better visibility and control of their operations. BrightDrop Core will be available in early 2023.

The commercial sector for electric vehicle is expected to grow faster than private vehicle segment as commercial consumers tend to buy in large numbers and are expected to see real cost benefit transitioning to EV.

US electric vehicle start-up, Rivian, which has 100,000 orders from Amazon, that also happens to be an investor, is struggling to fulfil orders.

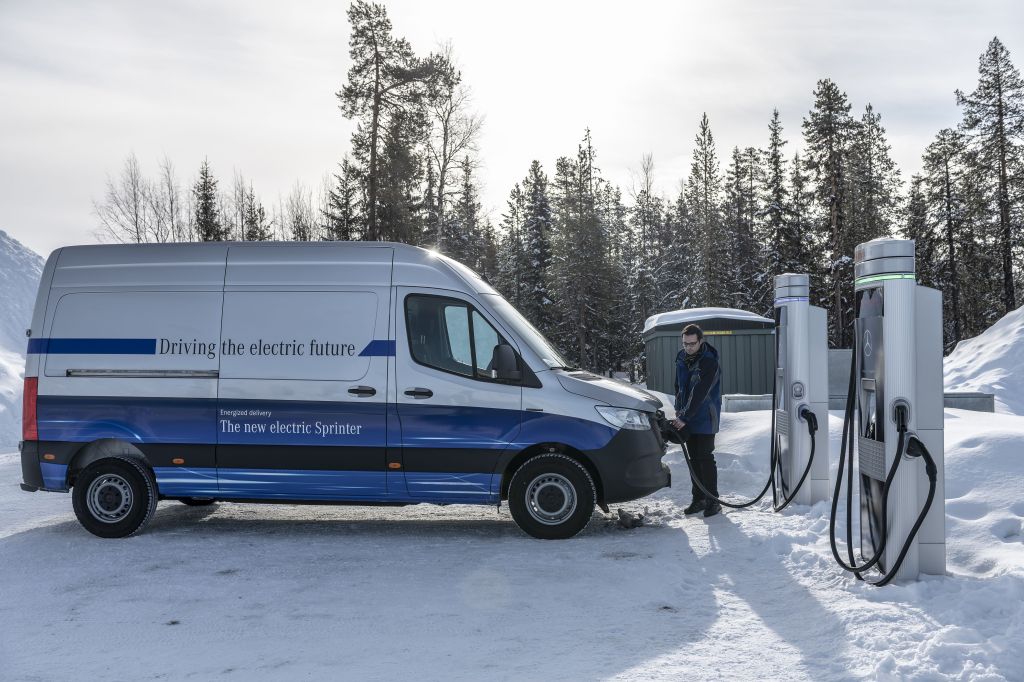

Recently it announced plans to work with Mercedes-Benz in Europe but put on hold its plan as company looks to conserve cash and focus on domestic production amid deteriorating economic conditions.

In September, the companies had signed a memorandum of understanding to open a joint plant in central Europe to produce battery electric delivery vans, stating that joint purchasing and other synergies would enable them to increase market share more quickly.

However, on Monday, Rivian said it wanted to “pursue the best risk-adjusted returns on our capital investments” and was therefore pausing the partnership with Mercedes. Rivian is currently in the process of developing a new generation of consumer vehicles and already has US manufacturing operations making a pick-up truck and sport utility vehicle, as well as a delivery van for Amazon.

Mercedes-Benz said it “respects and understands” Rivian’s decision, but will still proceed with a new plant in Jawor, Poland.

Mathias Geisen, head of Mercedes-Benz Vans, said that “exploring strategic opportunities with the team at Rivian in the future remains an option, as we share the same strategic ambition: accelerating the EV adoption with benchmark products for our customers.”

This was set to be Rivian’s first international expansion, as the company has previously faced setbacks in starting its own production in the US. Earlier this year, supply chain disruption caused Rivian to halve its expected output from its plant.

At the end of September, Rivian had around $14bn of cash or cash equivalents, down from $18bn at the beginning of the year. Its cash burn for the third quarter was approximately $1.4bn. In an October shareholder update, the company said it “remains confident in our ability to fund operations with cash on hand through 2025, excluding the impact of the investment in the currently contemplated joint venture with Mercedes-Benz.”